In the ever-evolving world of cryptocurrencies, where digital gold rushes happen daily, understanding the financial dynamics of mining equipment is crucial for investors seeking substantial returns. Bitcoin, Ethereum, and even Dogecoin have transformed ordinary computers into potential profit machines, but the real question lingers: do the costs of acquiring and maintaining mining rigs justify the earnings? This detailed study delves into the return on investment (ROI) for mining equipment, exploring everything from initial purchases to ongoing operational expenses. As the crypto market surges with unpredictable volatility, enthusiasts must weigh these factors carefully to avoid pitfalls and maximize gains.

Let’s start with the basics of mining equipment costs. A typical Bitcoin miner, often referred to as an ASIC rig, can set you back anywhere from $500 to several thousand dollars, depending on its hash power and efficiency. For Ethereum enthusiasts, GPU-based miners offer flexibility but come with their own price tags, sometimes exceeding $2,000 for high-end models. Meanwhile, Dogecoin mining might seem more accessible with standard CPUs, yet scaling up requires investments in robust hardware. These upfront costs are just the tip of the iceberg; add in electricity bills, which can devour hundreds of dollars monthly, and the equation becomes more complex. Hosting services, popular for those without space or expertise, charge fees that vary widely—expect to pay $100 to $500 per month per rig, depending on the provider’s location and security features.

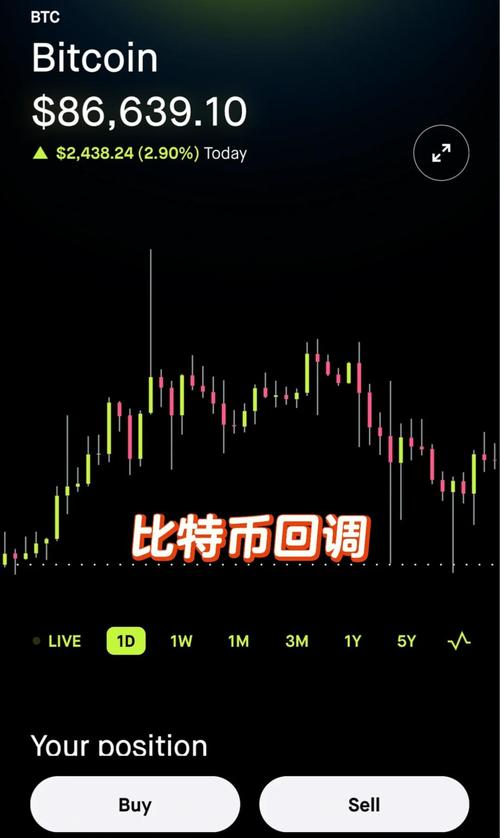

Beyond the expenses, the earnings potential paints a vibrant picture of opportunity and risk. Bitcoin’s blockchain rewards miners with newly minted coins and transaction fees, but profitability hinges on factors like network difficulty and market price. Imagine a scenario where a single mining rig generates 0.01 BTC per day; at a price of $60,000 per BTC, that’s $600 in daily revenue before costs. Ethereum mining, especially before its shift to proof-of-stake, offered steady yields through ether rewards, though competition has intensified. Dogecoin, with its lighter network, might yield quicker but smaller payouts, perhaps 100 DOGE per day, equating to mere dollars if prices dip. These earnings fluctuate wildly, influenced by global events, regulatory news, and technological advancements, making long-term predictions a thrilling yet treacherous game.

Now, consider the role of mining farms and professional hosting in enhancing ROI. Large-scale operations, like those in dedicated mining farms, pool resources to achieve economies of scale, reducing per-unit costs through bulk purchases and optimized energy use. For instance, a miner in a well-managed farm might see electricity costs drop by 20-30% compared to home setups, boosting net profits significantly. However, this convenience demands trust in hosting providers, who handle everything from maintenance to security. In contrast, individual miners using personal rigs face greater variability—technical failures or power outages can erase weeks of earnings in an instant. The diversity of these approaches underscores the unpredictable nature of crypto mining, where strategy and adaptability reign supreme.

Delving deeper into ROI calculations, we can use a simple formula: ROI = (Net Profit / Total Investment) x 100. Suppose you invest $3,000 in a miner that earns $1,000 monthly after costs; over a year, that’s $12,000 in revenue minus the initial outlay, yielding an ROI of 300%. But wait—fluctuations in ether or Dogecoin prices could slash that figure dramatically. Exchanges play a pivotal role here, as miners must sell their rewards on platforms like Binance or Coinbase, navigating fees and market timing. The burst of activity in these markets, with prices soaring or plummeting overnight, adds layers of excitement and peril, demanding investors stay vigilant and informed.

In conclusion, the balance between mining equipment costs and earnings is a delicate dance of innovation and caution. While Bitcoin and Ethereum offer substantial rewards for the persistent, Dogecoin appeals to those chasing quick, albeit volatile, gains. Whether you’re running a solo miner or opting for a hosted mining rig in a professional farm, the key lies in meticulous planning and risk management. As the crypto landscape continues to evolve, this ROI study serves as a beacon, guiding enthusiasts toward informed decisions in a world where fortunes can change with the click of a mouse.

Leave a Reply